the ultimate guide for an independent future

your Journey

starts here

What

is

your

Journey?

we’re fighting a losing battle with the economy

what do you do when you’re on the losing team? switch sides!

but together can join forces

life gets harder by the year. you get older and wages stay the same

wages are low while costs are high; money is stretched and there is no hope of saving, right?

how are we ever to grow up when independence costs more than we make in a year?

there is always hope, and it’s not a pipedream, but a realistic vision of tomorrow. a brighter future is possible, and i’m going to show you how.

what do you need in life,

a deposit for a house?

a rainy day fund?

something for later in life?

or an early retirement, like me?

These are all achievable dreams through sustainable, long-term, and low-risk investment.

increase your money’s value! make savings, get richer and smarter - in a way that helps yourself, and the economy too! get peace of mind that you’re making progress to an independent future!

super easy to do

a Fork in the Road

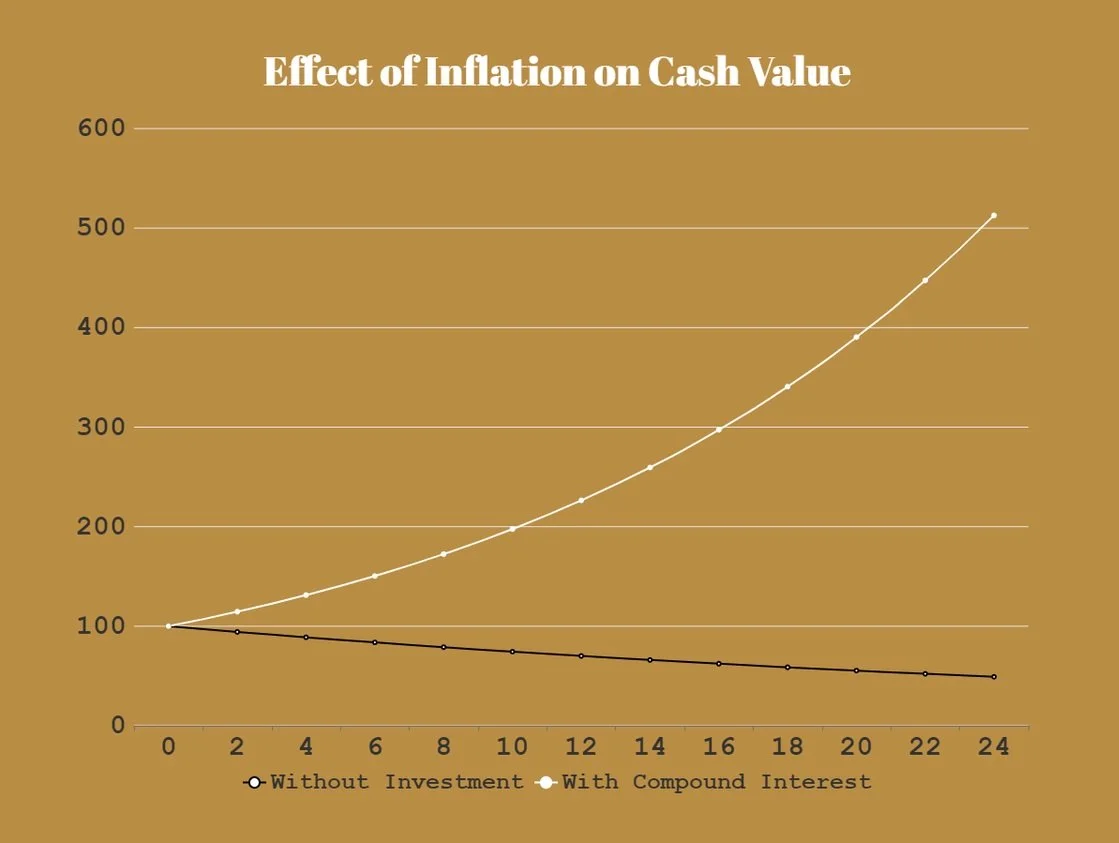

two projections of your future - which path will you take?

a leaky tap

your wallet is leaking, and the plumber’s on holiday.

your money is losing value. not only are you fighting the rising tide of everyday expenses, but in a year’s time, your money will cover fewer expenses than it does today.

inflation means your money loses it’s absolute value over time - an annual inflation of 3% means the cash in your pocket is worth about 3% less in 12 months time.

plug the leak

but this is an easy fix - by investing in your future you can not only plug the leak and retain your money’s value, but actually increase it (every single year!), and i’ll show you how

it’s not difficult, and it’s not a fantasy - this is maths in action

notice how the line goes up at an increasing rate - this is exponential growth, and is an inevitable (mathematical fact) benefit of compounding interest - the longer you’re invested, the more you make at rate that increases faster and faster over time.

Just (for fun) to give you an idea of the power of compound interest, ive left in the graph data without the inflation.

hover image of your money in 10 years, with/without investment

needs to be a graph for visuals

maybe table too??

Through the Looking Glass

to achieve our goals, we’re going to take advantage of compound interest

from 1957 to december 2023, the S&P 500 has an average annual return of 10.26%

this isn’t about making fast gains - buying and selling stock like The Big Short or

In 10 years, you’ll double your money!

-

A collection of companies that have opened themselves up to investment. Usually grouped by country, size, and/ or sector. Examples are the S&P 500, FTSE 100, or the Euro STOXX

-

A collection of the USA’s biggest, most successful companies. It has been one of the worlds most stable and best-performing markets for over 60 years.

-

A type of investment that aims to track the performance of the overall market as accurately as possible. Money put into an index fund goes into buying stocks in all the companies in the market.???

-

The act of an return of an investment (Interest) reinvesting itself year-on-year, and therefore growing exponentially.

achieve self-sustaining interest

acquire a mortgage

get to 500k

complete phase two in year 15

Graph of s&P growth since 1957

calculator of how much you could earn

tldr, gimme the scoop

to achieve our goals, we’ll be investing in an S&P 500 Index Fund. This is a long-term, low-risk approach to investing that is extremely easy to do.

We’re growing our money the sensible and sustainable way through

this isn’t about making fast gains - buying and selling stock like The Big Short or the Wolf of Wall Street - instead we’re buying when we have a spare bit of money, and selling only when we have achieved our goal.

The key to growing a pot of money sensibly

Long-term, sensible growth

this isn’t about making fast gains - buying and selling stock like The Big Short or the Wolf of Wall Street - instead we’re buying when we have a spare bit of money, and selling only when we have achieved our goal.

Don’t sweat the small stuff -

“the stock has changed 1% in the last 24 hrs, should i sell???”

The timeline for our goals is years not days. History tells us if we relax and let the market do its thing, we will get our returns in the long-term. We sell when the time is right: when our goal is reached.

Start Your Journey

want to join in on the fun and achieve your goals? learn how small and steady investments can grow into a goal-achieving wrecking ball.

whether you need a nest-egg, a deposit for a house, or something for later in life, start your Journey today and make the first step.

-

You don’t need to be saving big chunks of money to start investing - small and steady amounts build up surprisingly fast!

-

This isn’t about quick gains or doubling your money overnight. But sensible long-term investment that will be the foundation of your future

-

sit back and let the money grow. By focusing on passive investment, you eliminate the risk & stress of buying and selling

-

Many people get turned off by the complexity of investment, but really it’s as easy as opening a bank account

-

secure your future & make the first step towards the best decision of your life

10%

Completion

14 years to go…

one year down, and so far things are going to plan. big strides were made, and the key targets were hit.

but there’s uncertainty on the horizon, as i end the year down to part-time work and in-between jobs.

enjoy all the highs and lows in the year one: report in full - available now

over the next 15 years, i’ll be squeezing every penny i can to reach year 15 with a house, a car, and a 500k portfolio.

passive, low-risk investments with a 10% annual return.

focus on passive, low-risk investments with a 10% annual return

by focusing on passive, market-linked investments

Donec id justo non metus auctor commodo ut quis enim. Mauris fringilla dolor vel condimentum imperdiet.